The Founder Confidence Index: Driving Company-Investor Fit

So far, we’ve only discussed pricing an investment through the lens of the venture investor. While some might argue that the venture investors’ willingness-to-pay for equity should serve as a signal for the true value of a business, especially given the sheer volume of those doing so, this approach completely ignores the supply-side of the market: the founders.

Each individual founder has a unique story and set of factors that ultimately determine how much equity he or she is willing to sell in exchange for the capital to get the company off the ground and pursue its potential growth. Therefore, it’s fair to say that the initial valuation a company receives is as much a reflection of the founders’ willingness-to-sell equity as it is a reflection of venture investors’ appetite to purchase it.

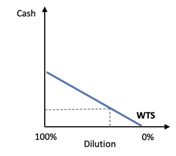

So what does this look like? Here’s a few assumptions to build a graphical representation.

Postulate 1: No founder would be willing to sell equity for less than $0. This is represented on the chart at point P1.

Postulate 2: All founders raising venture money have a price at which they would sell 100% of the business for today, if offered. This is represented on the chart at point P2.

Conclusion: There exists a line between points P1 and P2 that implies the dilution a founder is willing to incur in order to reach some future exit greater than P2. This is a founder’s minimum willingness-to-sell (the “WTS”). Any terms presented by investors underneath the WTS line will not be accepted by the founder, regardless of whether or not one of these offers is an indication of the true value of the business.

This WTS line has a slope that we call the founder’s Confidence Index (“CI”). A founder with a steeper WTS line is inherently more confident in the business’ long-term and more willing to incur short-term risk to achieve that long-term goal.

The CI is driven by both objective Company Factors as well as Founder Factors.

Company Factors include:

Revenue Growth

User Growth

Operating Runway (No of mos of Cash)

Favorable Market Conditions

This is pretty straightforward. Series A companies should have a CI than their Seed counterparts, as they’ve presumably proven product-market fit and acquired referenceable paying clients or a strong user base to show the business model is working.

As such, the Confidence Index is also impacted by what we call Founder Factors. These influences can include:

Founder Financial Health

Prior Success

Strength of Advisors

Actual Confidence (naysayers might say Arrogance, though we consider it to be measured conviction) in the idea or themselves

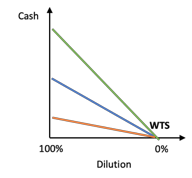

It is possible that two identical companies could have different willingness-to-sell lines depending on their founding teams’ varying Founder Factors. For instance, let’s take the figure below. The green line would represent a company whose CEO is a billionaire from the success of a prior business, and the orange line would represent the same company but with a CEO who’s a new parent and still paying off student loans.

Green CEO is far more willing to take on risk than Orange CEO

These lines are critical for investors to understand, and part of understanding whether or not the investors and the founders are aligned in their desired outcomes. Founders with higher Confidence Indexes may be unwilling to raise capital at valuations the market deems appropriate, creating long-term financing risk, while founders with lower CIs are more likely to sell the business early, blunting potential long-term investment returns.

—

So why do we focus on this?

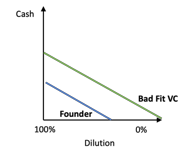

We believe that founder-investor alignment is critical to maximizing the returns of any business. As equity investors, venture investors join this curve alongside the founding team — and are typically doing so with Preferred investor rights such as the ability to block a sale of the business.

If an investor’s desire for return on investment is too dramatically different than the founder’s, then the founders and investors can never be aligned towards a common goal of success at the business.

This is the basis for “founder-investor” fit, shown in the graph below. While the “Bad-Fit VC” in this case would’ve likely paid a higher valuation for an investment in the founder’s company, seemingly beneficial for the founder, they also bring with them expectations and mandates to sell at much greater values, bringing an added risk profile to the long-term health of the business that is beyond what the founder believes is feasible.

At Tuhaye, a big part of our diligence goes into understanding the founders’ long-term vision and Confidence Indexes towards these outsized returns. As seed-stage investors, we are the longest time-horizon investors in the business outside of the founding team, so alignment to the founders is critical in making our investments succeed. There are mechanisms for adjusting the slope of the founder’s confidence index to reflect such events as secondary purchases of founders’ equity or salary considerations to reduce any financial stress on the team. Both sides of the table should continue to probe each other on these questions over the life of an investment to maintain continued alignment to a mutually agreeable and successful outcome.