Equity Leverage And Measuring Risk

Part II of Valuation Theory and the Flawed Premise of “Pre-Money” Valuation.

At Tuhaye, we strive to quantify early-stage risk so that we can utilize it in our pricing methodology. One of our simple measures to evaluate the underlying Risk at an investment is to look at a company’s Equity Leverage at the time of financing.

Equity Leverage is the amount of return a company needs to deliver on invested capital in order to meet an investor’s return expectations.

Let’s consider investing $2M in a concept-stage business priced at a $10M post ($8M Pre, but building off the assumptions in Part I, the non-venture backed value of the business is $0). If as investors we’re targeting a 100% IRR, then the investment needs to be worth $20M in 12 months. Therefore, the team needs to create $20M of value on a $2M investment, putting 10x of Equity Leverage on the business.

Now let’s take that same business, but suppose an investment of $4M at $14M post-money ($10M “Pre, $0M Actual). Targeting the same 100% IRR, the company needs to be valued at $28M in 12 months to merit consideration from the same investor group. However, the Equity Leverage on this investment is a more conservative 7x, or 42% lower from a risk standpoint.

From the founder’s lens, there’s some simple logic to how this translates into risk. The CEO who is under pressure from investors to return 10x on every dollar they spend is more likely to spend it on high-risk initiatives (cheaper labor, experimental marketing strategies for example), than a founder who only needs to return 7x.

A founding team that assumes too much Equity Leverage is more likely to fail through high-risk growth strategies, rather than another business that is spending money more conservatively.

So as the investor constructing a term sheet now, which is the better term sheet to propose? Should you maximize your MOIC and ownership by investing $2M at the lower pre-money valuation, or should you minimize your risk exposure by investing $4M at a 40% higher post-money valuation, but that features less equity leverage? (Recall that despite a lower MOIC, both investments have the same IRR)

What you’ll find is that a portfolio with a 42% reduction in equity leverage (10x to 7x), outperforms the portfolio that has a 40% greater upside on each investment.

This is done by deploying $52M across 26 companies at an $8M Pre-Money ($2M Ea), or deploy twice that capital into the same companies at a $10M Pre-Money ($4M Ea). In both funds, the companies will grow at the same rate (100% IRR), and sell to the same acquirer for $900m**, delivering ~90x or 64x (a reflection of the 40% higher post money paid).

** For simplicity sake, I’ve assumed no new cash into each company post initial investment, but you could also assume both companies experience the same dilution over time from future investment.

As a manager, let’s assume my ability to properly identify risk results in investing in these types of exits 5% of the time, (let’s call it “ALPHA”). If Equity Leverage translates into Risk, then by investing in a portfolio with 42% lower Equity Leverage, your ALPHA would increase from 5% to 7.14%.

In addition to having better portfolio returns, the 7.14% alpha portfolio with 26 investments is much more likely to have multiple unicorn investments (1.86), compared to the 5% alpha portfolio (1.3), which is likely to drive better fundraising cycles for the managers.

• • •

So why is this important? Getting back to the focus on “Pre-Money” values from Part I, by showing through investing in the $4M round, not only did we deliver a greater overall return across the portfolio, but we did so by increasing the Pre-Money on the investment.

(Scenario A was $2M on $8M. Scenario B was $4M on $10M. The difference between the two is $2M in invested capital and $2M in Pre-Money value)

This is demonstrative of “Pre-Money” being a function of the risk you perceive the business to have, rather than being indicative of the actual value of a company. If an investment is less risky because it has more available capital to spend and lower leverage on that capital, you should be willing to pay more for the investment.

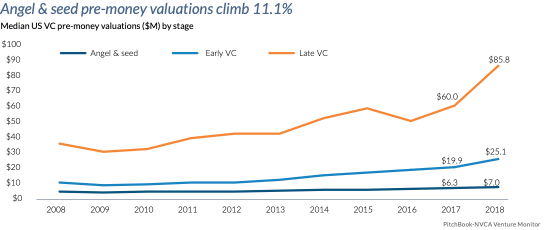

Keep this in mind next time you see a headline blaring “VALUATIONS SKYROCKETING”. Sure, angel and seed valuations are increasing (11%), but what’s ignored is that the median deal-size is actually outpacing that growth (15%), which is creating a less-risky environment for allocating capital characterized by lower equity leverage per investment. This is great news for the record $55BN in capital raised in 2018, and the record number of $1BN+ VC Funds (11) raised in 2018 to effectively deploy capital.

The “Brewster” Effect:

Obviously, there are limitations to pricing purely on Equity Leverage. For one, this logic would lead you to justifying higher and higher values on startups with minimal operations simply by virtue of other capital being around the table. In reality, there’s a diminishing return to reducing the equity leverage through additional capital that we call the “Brewster” effect.

For those of you who remember the movie “Brewster’s Millions”, Richard Pryor — having never made more than $11,000 / year in salary as a minor league baseball player, must spend $30 million dollars in 30 days with zero remaining asset value in order to inherit a $300 million dollar fortune. What Steve’s character finds out to our amusement — it’s actually extremely difficult to spend money quickly (in his case, waste it) if you actually have no experience doing so.

It’s not all that different for a venture-backed startup. A business only spending $50,000/month on operating expenses will have a very difficult time increasing their burn quickly AND efficiently. Take for example on hiring. It is much easier for a company of 100 employees to find and hire 9 employees than a company of 3.

Therefore, increases in the burn rate of a company also increases the risk profile of the investment. The higher the increase in OpEx, the greater the risk associated with spending money efficiently (and not hitting your Equity Leverage targets).

At Tuhaye, this is just one of the many ways in which we continue to refine our risk model to deliver returns to our investors. We’ll never eliminate failures from our portfolio given the high-risk nature of our investments, however as a fund if we can perfectly measure risk, then we can fully-diversify our fund to that risk in order to deliver high returns time and time again.